Learn Bookkeeping in Quickbooks in 2 weeks.

By the end of this course, you’ll be able to confidently handle your own bookkeeping and generate clean, tax-ready financial statements — using the exact system I use with my paying clients.

You will get:

· Your own QuickBooks Online Account

· 900+ Practice Transactions

· Practice Lease Docs, Loan & Bank Statements

· Step-by-Step Video Instruction

Learn how to set up and manage small business bookkeeping with zero guesswork using a real QuickBooks Online account, loaded with practice transactions from a real small business. By the end of this course, you’ll be able to confidently handle your own bookkeeping and generate clean, tax-ready financial statements using the exact system I use with my paying clients.

When you enroll, you get access to your own Practice QuickBooks Online Account loaded with all course materials. This is not a demo — you’re practicing on an actual bookkeeping client file.

This QBO crash course is designed specifically for new bookkeepers, corporate accountants, or business owners who need to learn how to do small business bookkeeping. You’ll follow a step-by-step course, designed by a tutor & firm owner, to set up tax-ready books from scratch:

🔹 Set up your Chart of Accounts — with clear rules to keep it simple and organized

🔹 Categorize transactions — and learn how to automate them with custom bank rules

🔹 Reconcile accounts — gain confidence your numbers are accurate every month

🔹 Generate and read financial reports — Profit & Loss, Balance Sheet, and more

🔹 Interpret key metrics — so you always know how your business is really doing

🔹 Practice with real documents — including sample loans, tax payments, and leases

Monthly QBO Access + Course Materials

Lifetime access to course materials.

💡 Note: When you cancel your subscription, access to your Practice QBO Account will be removed.

1-Year QBO Access + Course

Lifetime access to course materials.

1-Year of Access to Practice QBO Account.

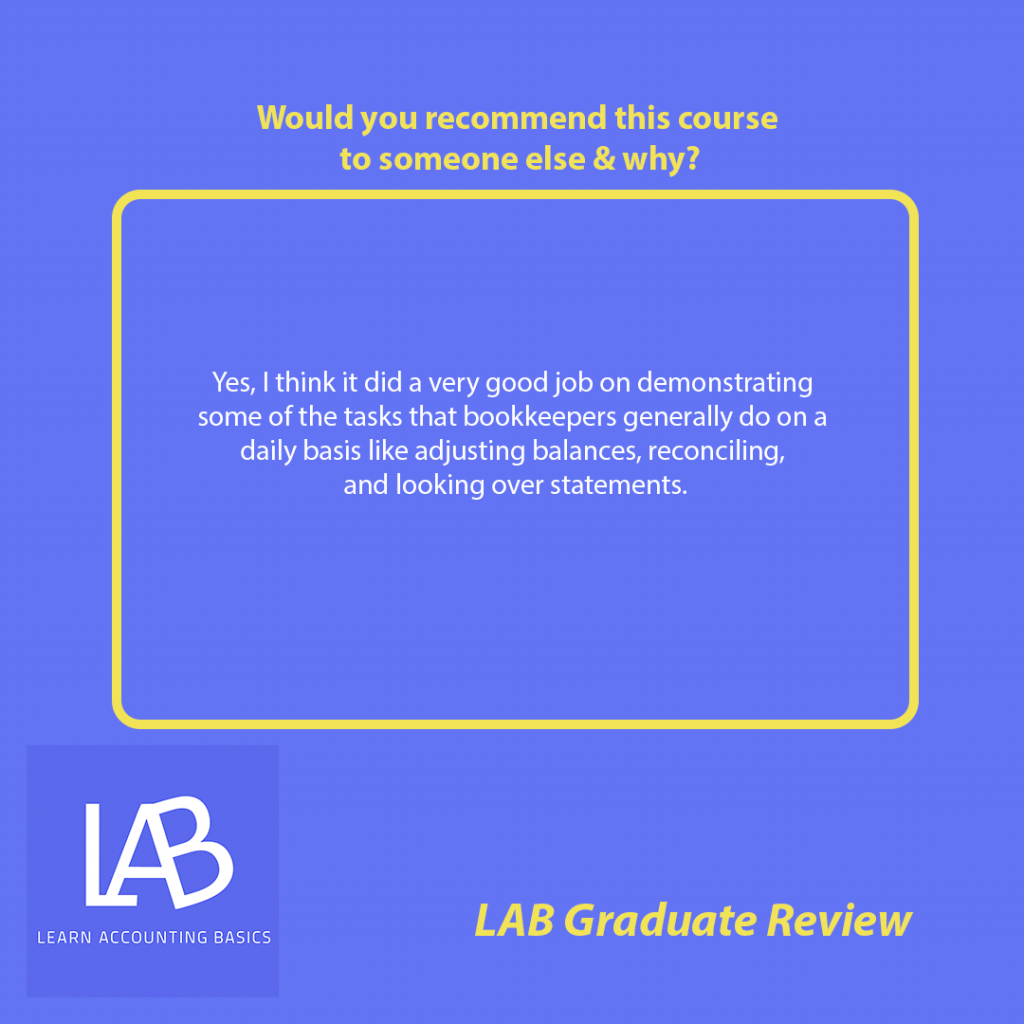

Just finished the course! Having no prior knowledge about bookkeeping this was a HUGE value! Thank you! I feel confident in going forward with looking into starting my own bookkeeping business. Here’s to my future success!

Prithvi is my personal accountant for 3 of my small business ventures. He is a wealth of knowledge, he isn’t just spitballing. The things he teaches in this course are valuable because I pay him 3k+ a month just for the books he does for my business. I wish I had enough time to learn myself but just think if you learn there are plenty of business owners with no time for to keep books for!